Instructions for Financial Projection Tool

Please read fully before using the tool.

The Financial Projection takes specific financial data from the church and will project out 10 years where your will be financially. The basis for these projections adds a 4% rate of inflation to expenses and calculates investments as having a 6% rate of return. Before you begin with the tool, there is data you will want to compile. This data is for a year. It is suggested you use the previous year’s financial data if you are using this tool between January and July. After July, it is suggested the previous 12 months, so your data is as accurate as possible. Make sure you have all the data and have recorded it correctly. Once you have submitted your data on the tool, there can be no corrections.

The first thing you will need to compile is the giving to your church at specific life stages. The stages are:

Under 20

20-30

31-40

41-50

51-60

61-70

71-80

80+

For each age range, you will need to know the total given by that group and the number of giving units. Should you have a couple giving with one person in one age group and the other in a different age group, place their giving total and count them as a giving unit in the younger age group. For the number of giving units, the minimum number of units for all categories is 1 even if there is no money given.

The tool will ask you how many new youth members annually. This would be those you anticipate moving from the under 20 category to the 20-30 category and becoming a giver. If this is uncertain, the default number is 0.

The next data you will need to collect is any other income that the church receives. The categories are:

– Rent

– Fees

– Grants

– Memorials

– Miscellaneous

If you receive additional offering beyond the age groupings, place that amount in Miscellaneous.

The total for the age range giving and the other incomes should be equal to the total income for the church for the 12-month period.

Next, you will need to pull the amount of any investments you have that could potentially be used toward the operations of the church. Even if an account is restricted, for example for Capital Improvements, that account could be used towards operations as part of the buildings & grounds expenses should the church find itself in a financial crunch. Items not included would be scholarships, endowments with restrictions, etc. You will also enter the year you are doing the projection, for example 2023, and the month, from 1 to 12.

If you anticipate a large expenditure within the next 12 months that would be covered by investment funds, such as replacement of a HVAC unit, new roof, etc., that amount would be entered where the form asks for immediate capital uses. This will reduce your investment amount after year 1 and then project out from that. If you are unsure, the default number is 0.

You will then need to have the total expenses for the 12-month period you are using for your projection.

The final number you will need to enter is the total cash on hand.

Once you have pulled all of this information together, complete the Financial Projection Worksheet provided to double check all information before entering it into the tool and hitting submit. All numbers should be whole numbers with no decimals. Double check all numbers before hitting submit as you will not be able to change your initial information once you hit submit.

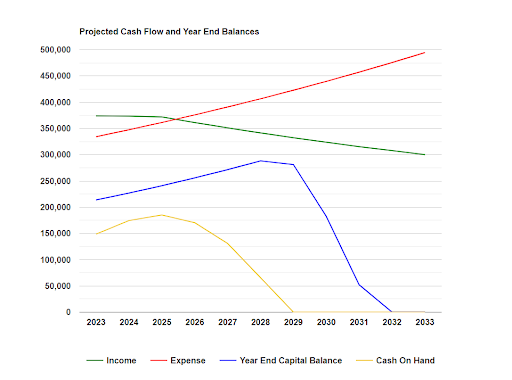

Once you have submitted your original data, you will get a notice on the screen that tells you it has been entered and that you will receive an email within a few minutes that will have a link to your projection graph. Once you click the link, your graph will be on screen and look similar to the graph below.

Once the initial baseline is established for a church’s Financial Forecast, the Financial Projection Tool allows users to input two hypothetical “modeling” scenarios. These models show what additional streams of revenue, rent, increases in giving, or other fund growth will impact the projected date when the church will run out of financial resources. It is strongly recommended that only realistic new streams of revenue are input into the system as to not generate a misguided projection.

After the initial information is entered, you may then make two adjustments to your data. For the adjustments, you may change:

– Growth of giving units by percentage

– Additional Income amounts by dollar amount

– The rate of return on investment by percentage

– A percentage of investment you will use each year.

– Growth rate of expenditures by percentage

– Reduction of expenses (must be entered as a negative number)

Each of the two adjustments will provide you with a new projection graph.